The 45-Second Trick For Which Type Of Bankruptcy Should You File

The 45-Second Trick For Which Type Of Bankruptcy Should You File

Blog Article

Bankruptcy Lawyer Tulsa Can Be Fun For Anyone

Table of ContentsNot known Facts About Tulsa Bankruptcy ConsultationRumored Buzz on Top Tulsa Bankruptcy LawyersNot known Details About Bankruptcy Attorney Near Me Tulsa Some Ideas on Tulsa Bankruptcy Filing Assistance You Should KnowTulsa Bankruptcy Attorney Fundamentals ExplainedThe Best Strategy To Use For Chapter 7 - Bankruptcy Basics

Individuals need to use Phase 11 when their financial debts go beyond Phase 13 financial debt limits. bankruptcy lawyer Tulsa. Chapter 12 insolvency is created for farmers and fishermen. Phase 12 payment strategies can be more versatile in Phase 13.The ways examination checks out your ordinary regular monthly revenue for the 6 months preceding your filing date and contrasts it against the typical earnings for a comparable home in your state. If your revenue is below the state typical, you instantly pass and do not have to finish the whole form.

If you are married, you can file for bankruptcy collectively with your spouse or separately.

Filing insolvency can assist a person by disposing of financial obligation or making a strategy to repay financial obligations. An insolvency situation typically begins when the debtor submits an application with the bankruptcy court. A petition may be filed by an individual, by partners together, or by a company or various other entity. All insolvency cases are dealt with in government courts under rules laid out in the U.S

How Top Tulsa Bankruptcy Lawyers can Save You Time, Stress, and Money.

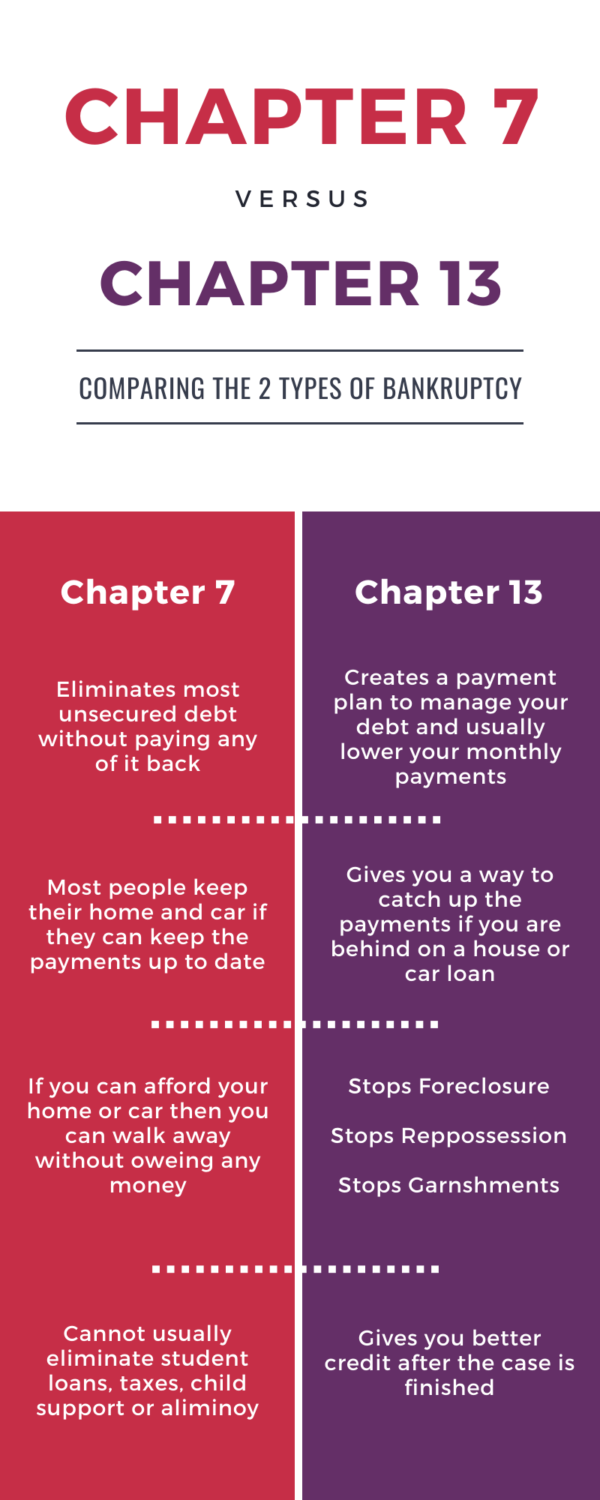

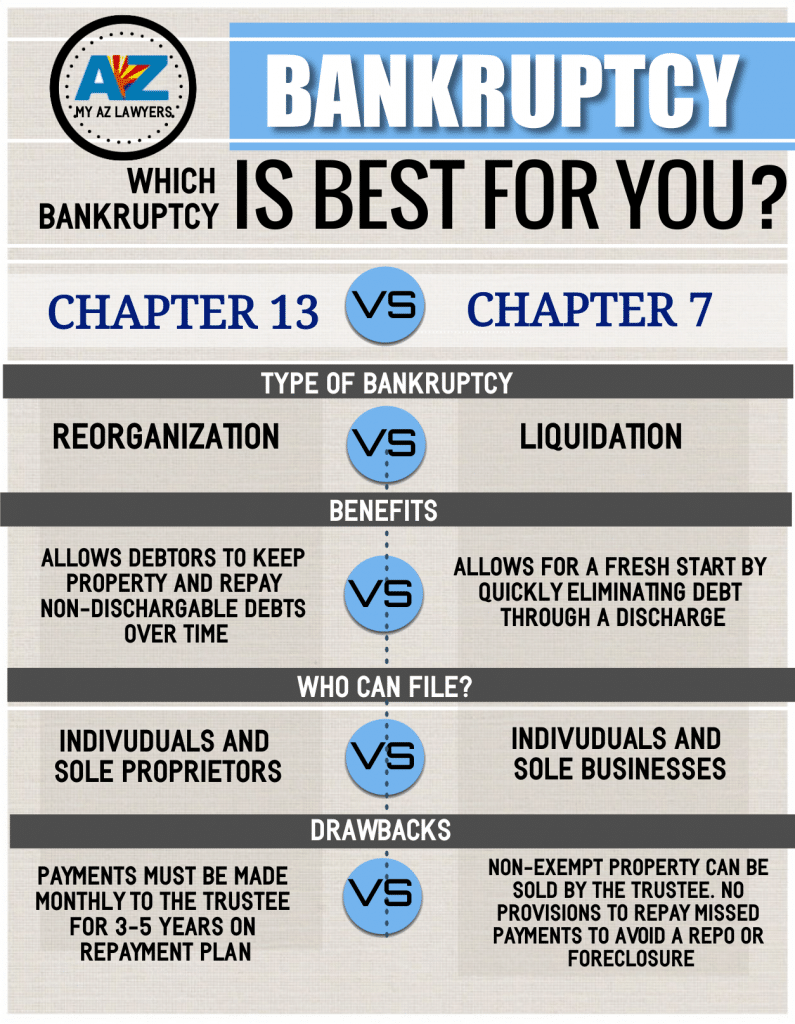

There are different sorts of bankruptcies, which are typically described by their chapter in the U.S. Personal Bankruptcy Code. Individuals may submit Phase 7 or Phase 13 bankruptcy, depending on the specifics of their circumstance. Municipalitiescities, communities, villages, tiring districts, municipal utilities, and institution districts may submit under Phase 9 to restructure.

If you are encountering financial difficulties in your personal life or in your company, possibilities are the idea of filing personal bankruptcy has crossed your mind. If it has, it also makes good sense that you have a great deal of insolvency concerns that require responses. Many individuals actually can not address the question "what is insolvency" in anything except basic terms.

If you are encountering financial difficulties in your personal life or in your company, possibilities are the idea of filing personal bankruptcy has crossed your mind. If it has, it also makes good sense that you have a great deal of insolvency concerns that require responses. Many individuals actually can not address the question "what is insolvency" in anything except basic terms.Lots of people do not realize that there are a number of kinds of insolvency, such as Chapter 7, Chapter 11 and Phase 13. Each has its benefits and difficulties, so understanding which is the most effective alternative for your present situation along with your future healing can make all the difference in your life.

3 Simple Techniques For Tulsa Bankruptcy Lawyer

Phase 7 is labelled the liquidation insolvency chapter. In a phase 7 personal bankruptcy you can remove, wipe out or discharge most kinds of financial debt.

Lots of Chapter 7 filers do not have much in the method of assets. Others have homes that do not have much equity or are in major need of fixing.

The quantity paid and the duration of the strategy depends upon the debtor's property, typical earnings and expenditures. Lenders are not enabled to seek or keep any collection activities or suits throughout the case. If successful, these creditors will be cleaned out or discharged. A Chapter 13 bankruptcy is extremely powerful because it offers a system for borrowers to avoid try this out foreclosures and constable sales and stop foreclosures and energy shutoffs while capturing up on their protected financial debt.

Rumored Buzz on Chapter 7 Bankruptcy Attorney Tulsa

A Phase 13 instance may be advantageous in that the debtor is enabled to obtain caught up on home mortgages or vehicle loan without the threat of repossession or repossession and is allowed to keep both excluded and nonexempt home. The borrower's strategy is a document describing to the insolvency court just how the debtor recommends to pay current expenses while settling all the old financial debt equilibriums.

It gives the debtor the opportunity to either offer the home or come to be captured up on home mortgage settlements that have fallen behind. An individual filing a Phase 13 can great site suggest a 60-month plan to cure or end up being present on mortgage settlements. For example, if you fell back on $60,000 worth of home mortgage payments, you could propose a strategy of $1,000 a month for 60 months to bring those home mortgage settlements present.

It gives the debtor the opportunity to either offer the home or come to be captured up on home mortgage settlements that have fallen behind. An individual filing a Phase 13 can great site suggest a 60-month plan to cure or end up being present on mortgage settlements. For example, if you fell back on $60,000 worth of home mortgage payments, you could propose a strategy of $1,000 a month for 60 months to bring those home mortgage settlements present.Getting The Tulsa Bankruptcy Filing Assistance To Work

In some cases it is better to prevent insolvency and resolve with financial institutions out of court. New Jacket also has an alternate to bankruptcy for businesses called an Task for the Advantage of Creditors and our regulation firm will go over this option if it fits as a prospective approach for your service.

We have actually produced a device that aids you choose what phase your file is probably to be submitted under. Go here to utilize ScuraSmart and find out a possible solution for your financial debt. Many individuals do not understand that there are numerous sorts of bankruptcy, such as Chapter 7, Phase 11 and Chapter 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we take care of all kinds of personal bankruptcy cases, so we have the ability to address your personal bankruptcy questions and assist you make the very best choice for your case. Right here is a short consider the financial debt alleviation options available:.

10 Easy Facts About Chapter 7 Bankruptcy Attorney Tulsa Explained

You can just file for insolvency Before filing for Chapter 7, at the very least one of these should be true: You have a lot of debt income and/or possessions a financial institution might take. You have a great deal of debt close to the homestead exemption amount of in your home.

The homestead exemption quantity is the greater of (a) $125,000; or (b) the region median price of a single-family home in the coming before calendar year. is the quantity of money you would certainly maintain after you marketed your home and paid off the home loan and various other liens. You can locate the.

Report this page